Calling for application of volunteers from Postal/Sorting Assistant cadre to work in PTC-Mysuru as office Assistant

PFRDA appoints Karvy as 2nd Central Record keeping Agency for NPS

Subscribers of National Pension Scheme (NPS) will soon have an option to

choose Central Record keeping Agency as the sector regulator PFRDA has

appointed Karvy Computershare to offer such services.

Currently, NSDL e-Governance Infrastructure is the only CRA, which

establish an internal system that delivers compliance with standards for

internal organisation and operational conduct, with the aim of

protecting the interests of NPS subscribers and their assets.

“Karvy Computer share Pvt Ltd is currently at an advanced stage of CRA

system development and is expected to become operational in the near

future,” said the Pension Fund Regulatory and Development Authority

(PFRDA).

Now there will be two CRAs operating in the NPS system – NSDL e-Governance Infrastructure and Karvy Compurtershare, it said.

Karvy was issued Certificate of Registration by the PFRDA in June last year.

“The choice of CRA can be made by the employer (existing or prospective)

between the existing CRA and the new CRA depending on the policy of

employer in case where there is employer-employee relationship,” the

regulator said.

Voluntary subscribers will have an option to choose a CRA while in the

case of NPS-Lite subscribers, the aggregator will decide on the CRA.

In case of government sector subscribers, the government will chose the CRA for rendering the services.

A CRA is responsible for recordkeeping, administration and customer

service functions for all NPS subscribers. The function includes

receiving instructions from subscribers through the points of presence,

transmitting such instructions to pension funds and effecting switching

instructions received from subscribers.

It acts as an operational interface between PFRDA and other NPS

intermediaries such as pension fund managers, annuity service providers,

and Trustee Bank.

As on November 30, 2016 there were about 1.4 crore subscribers under NPS with over Rs 1.61-lakh crore asset under management.

India Post to Start SBI Buddy Wallet Service in Post Offices

In order to move towards digitization of cash transactions at post

offices for its Saving Bank Customers, Department of Posts (DoP) has

approached the State Bank of India to provide customized services of

State Bank Buddy wallet for branches of Post Offices. Cashiers/Postal

Assistant at authorized Post Offices will accept two kinds of withdrawal

forms from their Saving Bank customers. One for withdrawing cash and

other for loading their Buddy wallet.

Draft of process flow is summarized below:

1. DoP would like to open wallets for their identified Post offices across India.

2. To begin with, DoP will start with 1000 Post Offices and then extend

to larger no. of Post Offices. All these Post Offices will be provided

with a smart phone, by the respective Divisional Heads/Chief

Postmaster/Sr. Postmasters. These phones Will be the assets of the post

Office concerned and Will be the deposited in the treasury at end of the

day. At the beginning of the day the phone will be given to the SB

Cashier handling the Buddy wallet.

3. State Bank Buddy wallet will be downloaded from Google play /Apple

store and wallet account will be registered on these (Post Offices’

Official) Mobile Numbers.

4. Sansad Marg HO will be assigned as a nodal office for SBl buddy. DoP

will share with SBl the list of mobile nos. to be used on Post Office

counters. Against each mobile no. in the list, name & address of PO

along with other details considered important for accounting and MIS.

5. SBI will prefund all 1000 post office e-wallet accounts with Rs.20,000 (each wallet to be topped up with Rs.20,000).

6. Cashiers/Postal Assistant at Post Offices will pay to their (PO)

customers, through P2P facility (using “Send Money/Ask Money) against

special withdrawal forms presented by the customers.

7. At 4.30 pm each day, Buddy Team at GITC will send MIS to NDMB (Sansad

Marg) & Sansad Marg HO containing the amount consumed by each PO

wallet during the day.

8. At the closure of Post Offices? customer dealing, 3:00 pm State Bank

Buddy team will run a scheduled job and block all these wallets so that

no further transactions can be made on that day.

9. Buddy team will generate Daily Transaction MIS of these wallets post office wise and share it with DoP

10. No PO wallet will be topped up during the day for increased requirement etc.

11. Buddy team will unblock these wallets in SOD (Start of Day) so that wallets will be operational for use.

1- Between Customer & Cashier/Postal Assistant

i. Customer should download buddy wallet from play store or apple store.

Assistance may be required. The cashiers/Postal Assistant will be

trained by SBI.

ii. Customer should use 'Ask Option" in Buddy giving mobile number of the Cashier.

iii. The statement of transactions on the wallet of the cashier can be made available by the Bank

At Post office

i. Debit SB account of customer

ii. Credit Wallet Account of customer

Reconciliation

The individual PO will download the Buddy report, check it against the transactions made and will

(A) Either confirm that the report tallied with the transactions done in the post offices, to the nodal office.

Buddy Wallet team (gmdigicomm@sbi.co.in)

Sansad Marg HO will pay SBl Sansad Marg main branch at the end of the

day as per demand raised by them. In the case of any dispute which is

raised by post offices as per para B above, the adjustment would be made

next day.

Central Government Employees are not yet given the full Benefit of 7th CPC Recommendation

The actual increase on account of implementation of 7th CPC recommendation is still not fully available to Central govt Staffs.

The recommendation of 7th Pay Commission has been implemented with

effect from 1.1.2016 and the revised salary is being paid from this

effective date. The Central Government, after implementing the Pay Panel

report, hasn’t announce any decision about Allowances even after 12

months, created frustration among central government employees.

The Pay Commission is constituted once in Ten Years to revise the Pay

and Allowances and Pension for Govt Servants and Pensioners.

Accordingly, the 7th Pay Commission was formed and it submitted its

report to the Government on 19-11-2015. The Government Accepted the

Report without any major changes and announced on 29.6.2016 that it

would be implemented with effect from 1.1.2016.

Since the increase in salary which is paid from 1.1.2016 was very less, it has demolished the expectations of CG Staffs.

Very important aspect in revising Pay and Allowance is House Rent

Allowance. The rates of HRA is determined based on the Population of the

Cities in which the Govt Servants are working. Accordingly, 10,20 and

30% of Basic Pay is paid as HRA in Sixth CPC. The 7th CPC has

recommended to revise it as 8%, 16% and 24%.

The Unions and Federations demanded to increase the HRA rates or at

least to restore the Sixth CPC rates. Hence the Government has announced

that a committee would be constituted to examine the Allowances, until

then all the Allowances would be paid in Sixth CPC rates. As a result

of this, HRA is being paid in old rates (Sixth CPC ) along with revised

7th CPC Basic Pay to CG Staffs. Now the CG Staffs have realized that

very purpose of forming a high-level committee is not for resolving the

issues but it is a delaying tactics.

Consequent to Pay Revision, the major increase in Salary is used to come

from HRA only. Though one year is completed after the implementation of

7th CPC recommendation, the Government is delaying to take the decision

over allowances. Due to this, the CG staffs are losing monitory

benefits considerably

For example ..

The increase in Pay and HRA of a Government servant who is drawing Rs.10000 in pre revised scale is given below …

| 6th CPC | |||||

| Basic Pay | DA (125%) | BP + DA | 10% HRA | 20% HRA | 30% HRA |

| 10000 | 12500 | 22500 | 1000 | 2000 | 3000 |

| 7th CPC | |||||

| Basic Pay | DA (0%) | BP + DA | 10% HRA | 20% HRA | 30% HRA |

| 25700 | 0 | 25700 | 2570 | 5140 | 7710 |

| Hike | |||||

| 3200 | 1570 | 3140 | 4710 | ||

If the Monthly salary of Government servant with 10Years of service is

Rs.22500, now the Actual increase of his salary is only Rs. 3200.

Through this example it is quite obvious that, one can get the real

increase in salary only after the HRA is paid in 7th CPC revised rates.

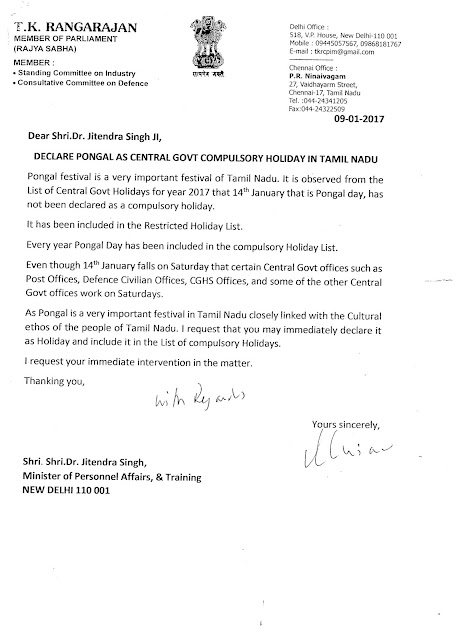

Declaration of closed holiday for Pongal on 14th January 2017 - Move Taken by Confederation

Move Taken by Confederation - Declaration of closed holiday for Pongal

on 14th January 2017 for Central Government Employees of Tamilnadu state

MOVE TAKEN THROUGH COM.T.K.R. , M.P. WITH THE MINISTER OF PERSONNEL & TRG. DEMANDING HOLIDAY FOR PONGAL IN TN

No comments:

Post a Comment