SALARY ADVANCE IN CASH. NO OPTION REQUIRED FOR CASH PAYMENT

Read para 2 of Fin. Min. OM – “In case no option is received by the said date, it will be presumed that the employees has opted for cash pay-out and payment thereof will be disbursed in cash accordingly”.

SECRETARY (POSTS) INSTRUCTED ALL CHIEF PMGS REGARDING EXCHANGE OF OLD NOTES IN POST OFFICES , PROVIDE SECURITY AND TO HELP THEM WITH PROVISION OF FAKE NOTE DETECTING MACHINES.

FINANCE MINISTRY ISSUED ORDERS TO PAY RS.10,000 IN CASH AS SALARY ADVANCE FOR NON-GAZETTED EMPLOYEES FOR THE MONTH OF NOVEMBER 2016

PROMPT HOLDING OF DEPARTMENTAL COUNCIL MEETING – SECRETARY, DOP&T WRITES TO ALL DEPARTMENTAL HEADS AS ASSURED IN JCM STANDING COMMITTEE MEETING ON 25.10.2016.

All affiliated organisations of Confederation are requested to take up the case with their Departmental Heads & ensure holding of Departmental Council immediately.

SECRETARY (POSTS) INSTRUCTED ALL CHIEF PMGS REGARDING EXCHANGE OF OLD NOTES IN POST OFFICES , PROVIDE SECURITY AND TO HELP THEM WITH PROVISION OF FAKE NOTE DETECTING MACHINES.

FINANCE MINISTRY ISSUED ORDERS TO PAY RS.10,000 IN CASH AS SALARY ADVANCE FOR NON-GAZETTED EMPLOYEES FOR THE MONTH OF NOVEMBER 2016

PROMPT HOLDING OF DEPARTMENTAL COUNCIL MEETING – SECRETARY, DOP&T WRITES TO ALL DEPARTMENTAL HEADS AS ASSURED IN JCM STANDING COMMITTEE MEETING ON 25.10.2016.

All affiliated organisations of Confederation are requested to take up the case with their Departmental Heads & ensure holding of Departmental Council immediately.

No exchange of notes for other-bank customers tomorrow (19/11/2016) ; senior citizens exempted

NEW DELHI: Indian Banks' Association on Friday said that all banks will serve only their respective customers tomorrow and will not exchange the old Rs 500 and Rs 1,000 notes from customers of other banks.

"All these days our own customers have suffered because we have not been able to do their work. So, we have seen lot of pending work at branches especially for our existing customers. We, from IBA, have taken a view that tomorrow, that is, on Saturday, we shall be exclusively doing work for our own customers. And tomorrow we will not be doing exchange of notes (for outside customers)," IBA chairman Rajeev Rishi said.

He, however, said senior citizens are exempted and they can go to any bank branch to exchange notes tomorrow.

The IBA decision is only for Saturday and from Monday onwards all customers will be allowed to exchange notes at a branch of any bank.

Commenting on the recent introduction of indelible ink marks on index fingers of those exchanging notes, Rajiv said, "Using indelible ink reduced queues substantially, it has come down to 40% of what it was initially".

Since Wednesday, banks have started applying indelible ink mark on the right hand index finger of customers in the select metro cities to stop repeat money exchangers thronging banks with invalid currency notes.

Earlier today, the government had warned that those who have allowed others to deposit money in their bank accounts, will be prosecuted for abetment under the Income Tax Act.

The finance ministry's directive comes against the backdrop of reports that some are using other persons' bank accounts to convert their black money into new denomination notes. If it is established that the money deposited in bank account does not belong to the account holder, it would be subject to tax, interest and 200 per cent penalty.

Since Prime Minister Narendra Modi's surprise announcement on November 8 to demonetise higher denomination notes of Rs 500 and Rs 1,000, banks and ATMs across the country have been witnessing serpentine queues to exchange now-invalid currency notes. Last week, banks across the country were open on both Saturday and Sunday to help the sudden currency crisis in the economy.

On Thursday, the government halved the limit of exchange of defunct notes to Rs 2,000. With effect from today, individuals can exchange invalid 500 and 1,000 rupee notes totalling Rs 2,000, as against Rs 4,500 earlier, till December 30

Source : http://timesofindia.indiatimes.com/\\

Don't Accept Demonetised 500/1000 Notes For Payment of PLI Premium

This Sunday (20.11.2016) is a Holiday to the Post Offices

Regarding Opening of Post Offices on Sunday (20.11.2016) for exchange of WOS Notes

I am directed to inform that the coming Sunday i.e. 20.11.2016 will not be a working day for the post offices. Instructions may be issued to all concerned.

With regards,

Sachin Kishore

Director (CBS)

Sansad Marg,

Dak Bhavan

Configuration of Cash limit in DOP finacle

- Second Week Started from 17.11.2016 to 24.11.2016

This is in continuation of trail mail on Cash Withdrawal limit in Finacle.

Week is configured as 10/11/2016 to 16/11/2016 and 17/11/2016 to 24/11/2016.

For eg: In case if Rs.10000/- was withdrawn on 10/11/2016, finacle will allow withdrawal of balance Rs.14000/- (revised limit – 24,000) within the above said period i.e. till 16/11/2016 for 1st week.

Every Group-C Officials Should give Option for Advance of Salary for the Month of November 2016

SALARY ADVANCE IN CASH. NO OPTION REQUIRED FOR CASH PAYMENT

Please Read para 2 of Fin. Min. OM – “In case no option is received by the said date, it will be presumed that the employees has opted for cash pay-out and payment thereof will be disbursed in cash accordingly”

Answer key for Paper - I, II & III SET-B for LDCE for Inspector of Posts - 2016 exam held on 22 & 23 - Oct - 2016;

Answer key for Paper - I, II & III SET-B for LDCE for Inspector of Posts - 2016 exam held on 22 & 23 - Oct - 2016

Thanks to Shri. Sunil V Kakad, Nagpur Region, MH

This key is not Official Key and answers shown in this key are not final. The Official Key will be available in www.indiapost.gov.in and is final.

Government silent on fresh bill to hike retirement age of High Court judges

Government silent on fresh bill to hike retirement age of High Court judges

New Delhi: Amid an ongoing debate on vacancies in the higher judiciary, government has preferred to maintain silence on bringing afresh a bill to increase the retirement age of high court judges from 62 to 65 years.

Responding to a question in the Lok Sabha yesterday on whether any proposal for extension of retirement age of high court judges is under consideration of government, Minister of State for Law P P Chaudhary said in a written reply that a bill brought by the previous UPA government in 2010 lapsed after the dissolution of the 15th Lok Sabha in 2014.

“The Constitution (114th Amendment) Bill, 2010 which provided for increasing the retirement age of High Court Judges from 62 years to 65 years was introduced in the Lok Sabha on July 25, 2010. Thereafter, the Bill was referred to the Parliamentary Standing Committee for examination and report, which recommended that the proposed bill in its present form should be passed without delay.

“The Bill could not be taken up for consideration and passing in the Parliament and lapsed with the dissolution of the 15th Lok Sabha,” he said.

The UPA proposal had sought to bring at par the retirement age of high court judges with that of Supreme Court judges at 65.

At a time when the 24 high courts face a shortage of nearly 450 judges, the government and the judiciary have agreed that an extraordinary provision of the Constitution can now be invoked to appoint retired judges with proven integrity and track record as judges of high courts to tackle rising pendency.

Nearly three crore cases are pending in courts across India.

PTI

WOS Currency Exchange Software V 3.2 Revised

Download from below links

Link 1 - DOWNLOAD

OR

Link 2 - DOWNLOAD

Uninstall the previous version first then install the new version.

From Version 3.0 to Version 3.2

1) Fixed Error of character length in Customer Name Field.

2) Given Default User name and Password to Create a New User (Only when SQL Server connection is succeeded).

Username = NJGADMIN

Password = NJGADMIN

3) Given unique color for all windows.

4) Fixed some bugs.

For any queries please mail to srikanta@live.in

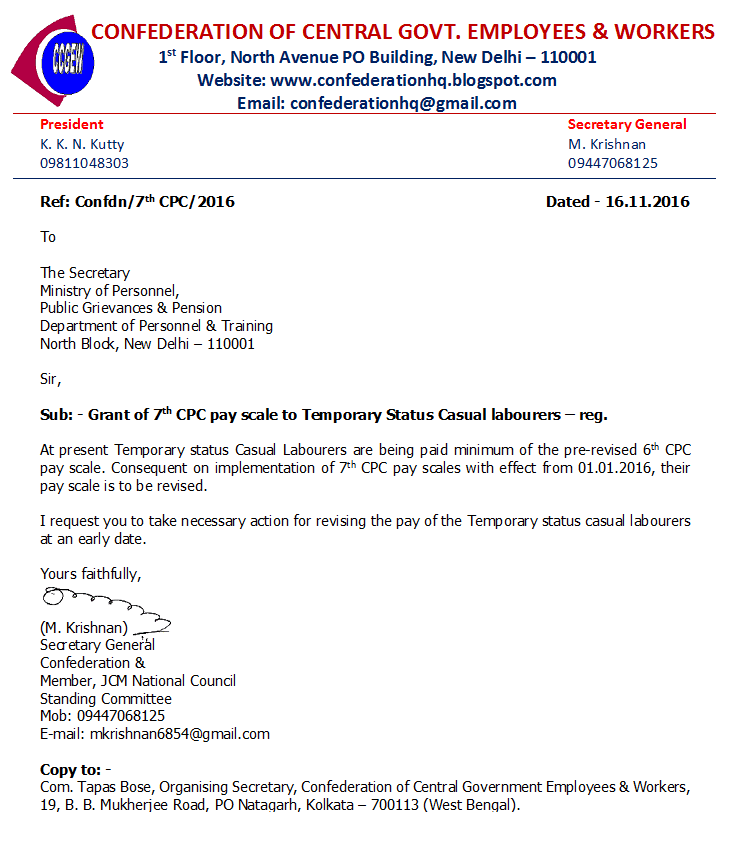

7th CPC pay scale to Temporary Status Casual labourers : Confederation writes to Ministry of Personnel, Public Grievances & Pension.

7th CPC pay scale to Temporary Status Casual labourers : Confederation writes to Ministry of Personnel, Public Grievances & Pension.

CONFEDERATION OF CENTRAL GOVT. EMPLOYEES & WORKERS

1St Floor, North Avenue PO Building, New Delhi - 110001

Ref: Confdn/7th CPC/2016

Dated - 16.11.2016

To

The Secretary

Ministry of Personnel,

Public Grievances & Pension

Department of Personnel & Training

North Block, New Delhi - 110001

Sir,

Sub: Grant of 7th CPC pay scale to Temporary Status Casual labourers - reg.

At present Temporary status Casual Labourers are being paid minimum of the pre-revised 6th CPC pay scale. Consequent on implementation of 7th CPC pay scales with effect from 01.01.2016, their pay scale is to be revised.

I request you to take necessary action for revising the pay of the Temporary status casual labourers at an early date.

Yours faithfully,

(M. Krishnan)

Secretary General

Confederation

Member, JCM National Council

Standing Committee

Source : Confederation

Rs.10000 Advance in the form of Cash Payout to Central Government employees on Rs.10000 Advance in the form of Cash Payout to Central Government employees on 23.11.2016

Central Government employees up to Group 'C' including equivalent levels in the Defence and Para Military Forces, Railways and Central Public Sector Enterprises will be given an option to draw salary advance up to Rs. 10,000/- in cash. This amount will be adjusted in their salary for November, 2016. It is expected that this decision will ease the pressure on the banks.

Press Information Bureau

Government of India

Ministry of Finance

17-November-2016 15:52 IST

The Central Government takes several decisions to facilitate farmers, small traders, Group ‘C’ Employees of Central Government including equivalent levels in the Defence and Para Military Forces, Railways and Central Public Sector Enterprises in the aftermath of the cancellation of the legal tender character of the old Rs. 500 and Rs. 1000 notes; Also decides to reduce the limit of exchange of old Rs. 500/- and Rs. 1000/- notes across the counter in banks from Rs. 4500/- to Rs. 2000/-with effect from 18th November, 2016.

In the aftermath of the cancellation of the legal tender character of the old Rs. 500 and Rs. 1000 notes, the Government of India has been receiving several suggestions including those from the State Governments. The Government has considered various suggestions and the following decisions relating to certain operational aspects of this scheme have been taken:

i. We are now at the beginning of the Rabi season. The farmers need various inputs for their agricultural activities. While the Government is keen on promoting payment through the banking or digital system, it is felt necessary to make some quantum of cash available with farmers to meet various expenses in connection with agricultural operations. It has, therefore, been decided that farmers would be permitted to draw upto Rs. 25000/- per week in cash from their KYC compliant accounts only. These cash withdrawals would be subject to the normal loan limits and conditions. This facility will also apply to the Kisan Credit Cards (KCC).

ii. Farmers are currently selling their produce from the Kharif season in the APMC markets/mandis. The farmers who receive such payments in their bank accounts through cheque/ RTGS will be permitted to draw up to Rs. 25000/- per week in cash. These accounts will have to be KYC compliant. This facility will enable the farmers to meet their various expenses connected with agriculture. This will also infuse lot of liquidity into the rural sector.

iii. Traders registered with APMC markets/mandis will be permitted to draw up to Rs. 50,000/- per week in cash from their KYC compliant accounts as in the case of business entities. This will enable these traders to pay wages and facilitate easy loading, unloading and other activities at the mandis.

23.11.2016

iv. For payment of crop insurance premium, States fix time limits depending on their local requirements and conditions. Consequently, the last date for payment expires on different dates. It has now been decided to extend the last date for payment of crop insurance premium by 15 days.

v. While encouraging families to incur wedding expenses through cheques or digital means, it has been decided to permit families celebrating weddings to draw up to Rs. 2,50,000/- in cash from their own bank accounts. These accounts have to be necessarily KYC compliant. The amounts can be drawn only by either of the parents or the person getting married. Only one of them will be permitted to draw this amount. This limit of Rs. 2,50,000/- will apply separately to the girl’s family and the boy’s family. The person drawing such amount has to furnish the PAN details. Further, a self-declaration will have to be submitted by the person to the effect that only one person from his/her family is drawing the amount. It is expected that members of the public will fully cooperate to ensure that the above guidelines are adhered to. Any misuse of this facility will invite appropriate action based on the self-declaration and other details.

vi. At present, over the counter exchange of old Rs. 500/- and Rs. 1000/- notes is limited up to maximum of Rs. 4500/- per person. Reports have been received that the same persons are going back to the counter again and again, thereby cornering the facility and depriving many other people from exchanging old notes.

There are also reports of organized groups indulging in such practices to convert their black money into white. It is now expected and desirable that people put their old notes into their bank accounts. However, for convenience of the people who may be on temporary visit either for work or otherwise, it has been decided to reduce this limit of exchange of old Rs. 500/- and Rs. 1000/- notes across the counter in banks from Rs. 4500/- to Rs. 2000/-. This facility will be available only once per person. The reduced limit of Rs. 2000/- will take effect from 18th November, 2016.

vii. Central Government employees up to Group 'C' including equivalent levels in the Defence and Para Military Forces, Railways and Central Public Sector Enterprises will be given an option to draw salary advance up to Rs. 10,000/- in cash. This amount will be adjusted in their salary for November, 2016. It is expected that this decision will ease the pressure on the banks.

Source: PIB

Transactions in relation to which quoting PAN is Mandatory

Press Information Bureau

Government of India

Ministry of Finance

17-November-2016 19:17 IST

Transactions in relation to which quoting PAN is Mandatory

The Income Tax Department prescribes a list of transactions for which quoting of Permanent Account Number (PAN) is mandatory. These are listed in Rule 114B of the Income Tax Rules, 1962 which were first inserted with effect from 1st November, 1998 and have been amended from time to time. The list under Rule 114B as on date requiring PAN to be quoted includes the following banking transactions :

- Deposit with a banking company or a co-operative bank in cash exceeding fifty thousand rupees during any one day.

- Purchase of bank drafts or pay orders or banker's cheques from a banking company or a co-operative bank in cash for an amount exceeding fifty thousand rupees during any one day.

- A time deposit with a banking company or a co-operative bank or a Post Office

- Opening an account [other than a time-deposit referred to above or a Jandhan / Basic Bank Deposit Account] with a banking company or a co-operative bank.

In addition to the existing requirement of quoting of PAN in respect of cash deposits in excess of Rupees fifty thousand in a day, quoting of PAN will now also be mandatory in respect of cash deposits aggregating to Rupees two lakh fifty thousand or more during the period 09th November, 2016 to 30th December, 2016 as per an amendment notified by CBDT on 15-11-2016.

The Department has already issued close to 25 crore PAN till date. The persons requiring a PAN for complying with the above requirement may do so by applying to the NSDL in a prescribed format with the necessary documentary proof. The link to the NSDL site and the instructions for making the application are available on the official website of the Income-tax Department www.incometaxindia.gov.in under the ‘Important Links’ head in the lower left hand corner of the homepage.

Meeting of the Committee on Allowances - NC JCM Staff Side

Meeting of the Committee on Allowances - NC JCM Staff Side

Today there had been a crucial meeting of the Committee on Allowances. They may finalize all the allowances in today’s meeting itself or some of them. This is just for your information. Further details shall be sent to you, once the same is available with us..

NON-SETTLEMENT OF LONG PENDING DEMANDS.

POSTAL JOINT COUNCIL OF ACTION

NATIONAL FEDERATION OF POSTAL EMPLOYEES

FEDERATION OF NATIONAL POSTAL ORGANISATIONS

ALL INDIA POSTAL EMPLOYEES UNION – GRAMIN DAK SEVAKS

NATIONAL UNION OF GRAMIN DAK SEVAKS

NEW DELHI - 110001

No.PF-PJCA-12/2016 Dated- 17.11.2016

To

The Secretary,

Department of Posts,

Dak Bhawan,

New Delhi-110 001

Sub: Non-settlement of long pending demands.

Sir,

A meeting of PJCA comprising NFPE, FNPO, AIPEU-GDS & NUGDS was held at NFPE office North Avenue Post Office Building, New Delhi on 16th November, 2016 under the presidentship of Shri D. Theagarajan Secretary General FNPO. All General Secretaries of both the Federations participated in the meeting. After threadbare discussion the following resolution, programme of action and Charter of Demand was finalized.

RESOLUTION

Postal Joint Council of Action (PJCA), views with grave concern the totally negative attitude of the Central Government in settling the common demands of the Central Government employees including increase in minimum wage and fitment formula and other modifications sought for by the National Joint Council of Action (NJCA) and JCM (NC) staff side.

This PJCA further notes that in the Postal department also due to the negative attitude of the Government and Postal administration long pending demands are remaining unsettled. None of the 7th CPC related demands of various cadres of Postal department are settled. Regularization of Gramin Dak Sevaks and grant of all benefits of regular employees on pro-rata basis is still pending. The New Pension Scheme (NPS) has created uncertainty among the employees recruited after 01.01.2004, about their pensionary benefits. Department has unilaterally issued orders for outsourcing booking and delivery of registered, speed post and express parcel post articles and engaging staff on each Sunday & holiday to deliver parcels of e-commerce companies . The task force committee recommendations are not yet dropped, no effective remedial measures are taken to streamline the functioning of CBS/CSI, revision of wages and payment of arrears of casual labourers from 01.01.2006 is still pending in many circles, more than 60000 vacancies in various cadres including promotional posts are remaining unfilled. Now due to monetization Scheme more difficulties are being faced by the staff due to lack of proper infrastructure and engaging staff beyond duty hours. All the above issues are agitating the minds of the employees for a long time.

The PJCA after reviewing the situation prevailing in the Postal department came to the unanimous conclusion that to settle the above issues, serious agitational programmes are to be launched. Accordingly the PJCA resolve to implement the following phased programme of action.

PROGRAMME OF ACTION

1. December-7th-2016 -Mass Demonstration in front of all offices and submission of resolution and Charter of Demands to Minister(C) and Secretary (Posts).).

2. Submission of Memorandum:

Submission of Memorandum to Minister by both Secretary Generals between 19thto 23 December, 2016 by meeting personally..

3. PJCA Meeting 23rd December, 2016 Evening (Further course of action will be decided.)

CHARTER OF DEMANDS

1. Settle the demands of various cadres of Postal department relating to 7th CPC recommendations submitted to Secretary, Posts in memorandum dated 08.12.2015.

2. Implement cadre restructuring in all remaining cadres in the Department of Posts and settle the residual issues arising at implementation stage. Finalize RRs in MMS Cadres.

3. Grant Civil Servant status to Gramin Dak Sevaks and grant all benefits of departmental employees on pro-rata basis.

4. Revision of wages and payment of arrears from 01.01.2006 to all casual, part-time, contingent and daily-rated mazdoors and regularization of services.

5. Fill up all vacant posts in all cadres including promotional posts and GDS.

6. Conduct membership verification of Gramin Dak Sevaks and declare the result of the verification already conducted among departmental employees during 2015.

7. Revision of OTA & OSA and fixation of norms for CRC/Speed post and Parcel in RMS and FMC for Postman Cadre .

8. Settle problems arising out of implementation of CSI and CBS.

9. Grant of upgraded 3050 pay scale to Postmen w.e.f. 1.1.1996 as per Supreme Court Judgment.

10. Withdraw “Very Good” bench mark condition for MACP and future increments and holding of DPCs timely..

11. Grant of S D.A. & HCA to the Assam & NE & remove discrimination.

12. .

13. Stop Sunday/Holiday working completely.

14. Discussion on Memorandum of AIPSBCOEA.

15. Declaration of Result of LGO & other LDCEs in remaining Circles.

16. Finalization of Recruitment Rules of AAO Cadre in Postal Accounts.

17. Repairing and Maintenance of Departmental Buildings.

Yours faithfully

R. N. PARASHAR D. THEAGARAJAN

Secretary General Secretary General

NFPE FNPO

No comments:

Post a Comment