NON-HOLDING OF SCHEDULED PERIODICAL MEETING

Com. Sitaram Yechuri intervened to end GDS Strike

Calculate Your 7th Pay Commission GDS Arrears

Finance Ministry approved 7th pay commission recommendation and waiting for cabinet approval for final implementation. Once the cabinet approves gds pay commission report, the increased salary and increased gds arrears from 01.01.2016 will be given from implemented date. Calculate your salary after 7th pay commission using GDS Salary Calculator 2018 | Designed After FinMin approval and here is how to calculate your GDS Arrears after implementation of pay commission from 01.01.2016.

Calculate your GDS Pay commission Arrears.

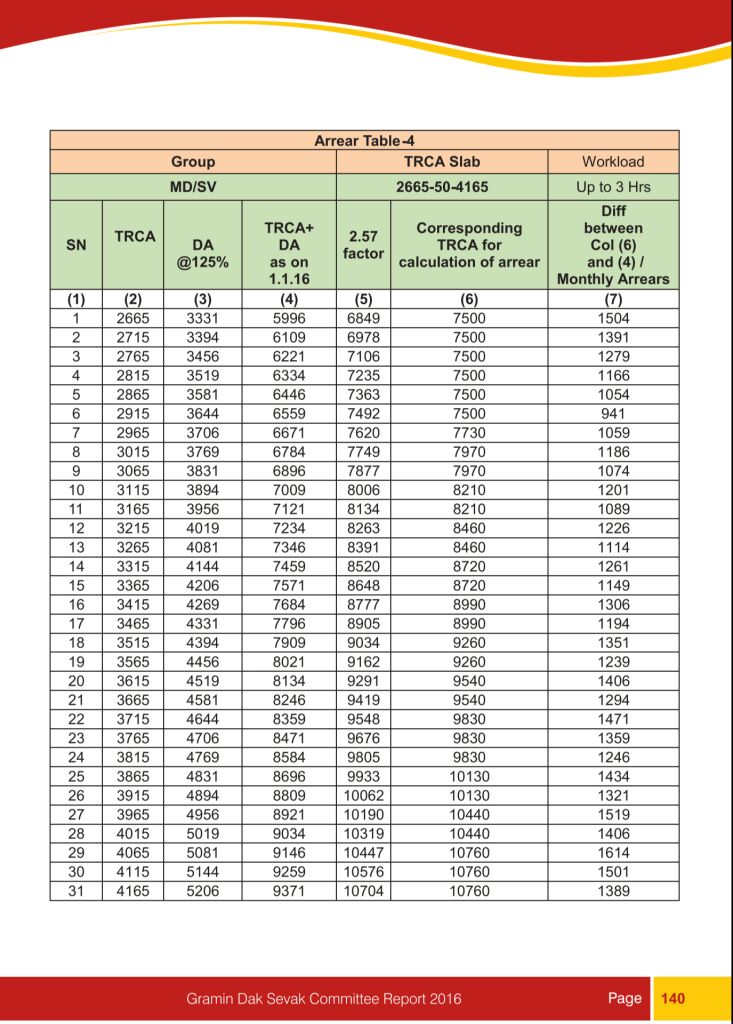

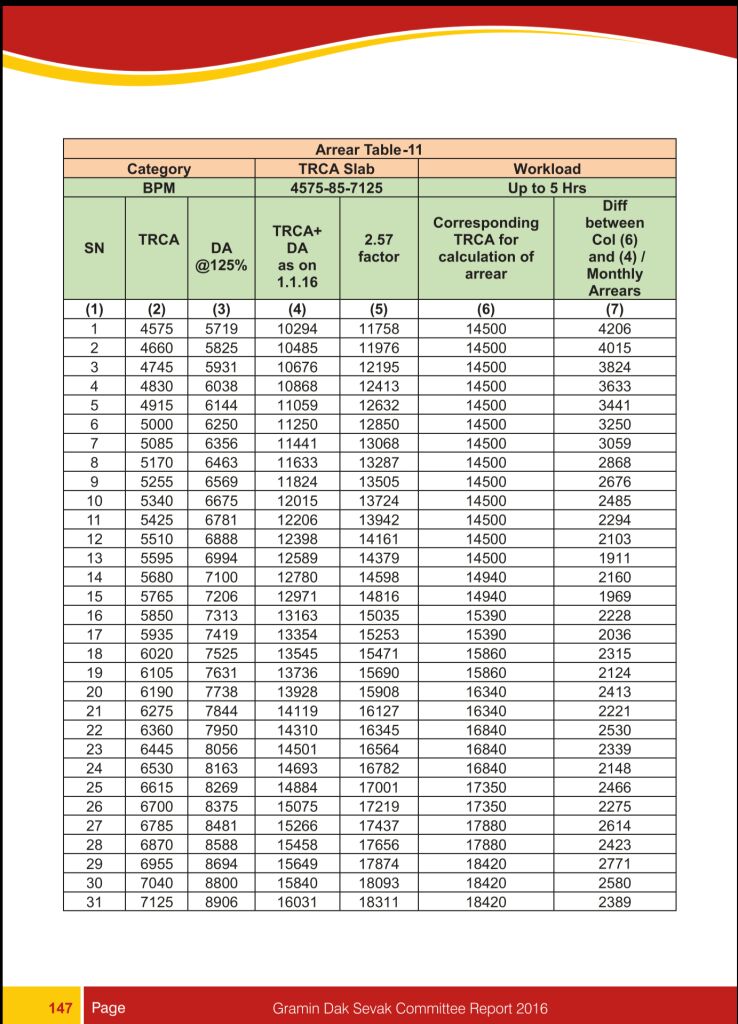

In order to calculate gds pay commission arrears, you must know your TRCA Slab. You can find it using below table,

If you are working as a Mail Carrier/Mail Packer/Mail Man and working hours between 3 to 5 hours, you will fall under tables from 1 to 3 accordingly. Like wise you can find your corresponding arrears table using above table.

GDS Arrears Table.

After knowing your arrears table number, you can go to the particular arrears table and calculate monthly arrears after implementation. Totally 11 different arrears table recommended by Hon. Mr. Kamalesh Chandra. These 11 tables are based on the above Trca table. Step by Step explanations given in end of the article.

Calculate Gds arrears.

Step 1: Know your TRCA slab and corresponding Arrears table. If you are working as a gds BPM with 3 hours working time, then your corresponding arrears table is 7.

Step 2 : Now Find your present Trca in corresponding arrears table. Let your present Trca is 2745, then your arrears per month is 2824/ per month. You can find it in col. no. 6 of arrears table.

Step 3. Now multiply your monthly arrears with number of months from 01.01.2016. In this case 2824 x 26 months = 73424. Rs Twenty Three Thousands and Four Hundred and Twenty Four only.

These calculations are based on the Hon. Mr. Kamalesh Chandra report. The arrears amount may after the approval from cabinet.

GDS Arrears Tables for BPM and ABPM with effect from 01.01.2016

On 06/06/2018, Cabinet Committee has approved the revision of pay structure and allowances of Gramin Dak Sevaks (GDS) of Department of Posts. Arrears for the period 01.01.2016 to the date of implementation will be paid by increasing the basic TRCA drawn during the period by a factor of 2.57. The arrears will be paid in one installment through POSB Account so that all GDS are requested to POSB Account before 15/06/2018.

Please see the Order Copy reg POSB Account is must for payment of Arrears Click here

Payment of arrears to GDS - Implementation of recommendation of GDS committee

The report of the GDS Committee is likely to be implemented very shortly. In this connection the competent authority has directed that payment of arrears on account of TRCA may be made through Post Office Savings Accounts Only. Therefore, I am directed to request you to ensure opening of SB Accounts for every GDS at their Post Office before 15/06/2018. Compliance report may be submitted to the Dte by 15/06/2018

Here we present the arrears table for BPM, MD/SV, MC/MP/MM separately…

A brief on the Cabinet approval of wage revision and allowances of GDS on 06-06-2018

A brief on the Cabinet approval of wage revision and allowances of

GDS on 06-06-2018.

1. Two categories of GDS : BPM & ABPM/Dak Sevaks.

2. Three TRCA slabs 10,000, Rs.12,000 & Rs.14,500

3.Level 1 & Level 2 with 4 hours & 5 hours of work.

4. Two levels each for BPMs & ABPMs

5. DA at par with regular departmental employees

6. exgratia bonus ceiling @ Rs.7000-

7. Date of Implementation: 01-01-2016

8. Arrears drawn with a factor of 2.57 and will be paid in one installment.

9. Annual increase @ 3% - option for 1 st January or 1 st July of every year

10. Risk & hardship allowance introduced

11. OMA. CDA. CCA. CMA. FSC & Boat allowances revised.

12. Retirement age remained as 65 years.

13. Discharge (retirement) benefits,

Welfare measures, not included here at present.

14. Other means of livelihood condition- may be retained

15. Estimated expenditure Rs.1257.75 crores during 2018-19.

by

Com.P.Pandurangarao,

General Secretary

AIPEU-GDS

GDS on 06-06-2018.

1. Two categories of GDS : BPM & ABPM/Dak Sevaks.

2. Three TRCA slabs 10,000, Rs.12,000 & Rs.14,500

3.Level 1 & Level 2 with 4 hours & 5 hours of work.

4. Two levels each for BPMs & ABPMs

5. DA at par with regular departmental employees

6. exgratia bonus ceiling @ Rs.7000-

7. Date of Implementation: 01-01-2016

8. Arrears drawn with a factor of 2.57 and will be paid in one installment.

9. Annual increase @ 3% - option for 1 st January or 1 st July of every year

10. Risk & hardship allowance introduced

11. OMA. CDA. CCA. CMA. FSC & Boat allowances revised.

12. Retirement age remained as 65 years.

13. Discharge (retirement) benefits,

Welfare measures, not included here at present.

14. Other means of livelihood condition- may be retained

15. Estimated expenditure Rs.1257.75 crores during 2018-19.

by

Com.P.Pandurangarao,

General Secretary

AIPEU-GDS

No comments:

Post a Comment