At present, Airtel and India Post are the only players that have started

Payments Bank operations. Meanwhile, Aditya Birla Idea Payments Bank is

expected to launch services in the first half of this year.

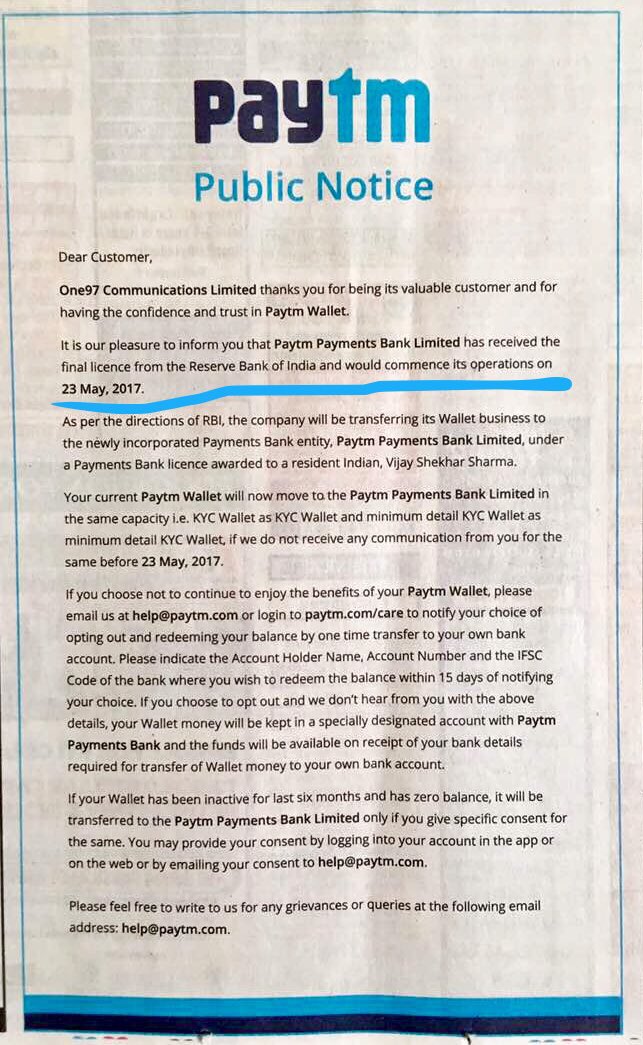

Mumbai, May 17: After months of delay, India’s leading e-wallet giant

Paytm is now all set to begin with its payments bank operations from May

23. Paytm has received the final approval from the Reserve Bank of

India (RBI) for its payments bank entity today. At present, Airtel and

India Post are the only players that have started Payments Bank

operations. Meanwhile, Aditya Birla Idea Payments Bank is expected to

launch services in the first half of this year. “We are delighted to let

you know that we have received the final licence for Paytm Payments

Bank from RBI and are in the process of launching on 23 May, 2017”, the

Paytm blogpost read. The company also announced that Vice President Renu

Satti will takeover as the new CEO of Paytm Payments Bank, replacing

earlier CEO Shinjini Kumar.

Paytm has over 218 million mobile wallet users. After May 23, the Paytm

wallet will move to PPBL. It has been reported that the company will

transfer its wallet business to the newly incorporated entity named PPBL

under the payments bank licence awarded to a resident Indian, Vijay

Shekhar Sharma. Sharma is the founder of One97 Communications that owns

Paytm. Sharma will hold the majority share in Paytm Payments Bank, with

the rest being held by Alibaba-backed One97 Communications. However, the

Chinese entity will not have a direct shareholding in the payments

bank, PTI reported.

Payments banks can accept deposits from individuals and small businesses

up to Rs. 1 lakh per account. In 2015, the RBI had awarded in-principle

approval to Sharma to set up a payments bank along with 10 others, PTI

reported. In a bid to deepen financial inclusion, the Apex Bank RBI

began an era of differentiated banking by allowing SFBs (small finance

banks) and PBs (payments banks) to start services. It has been reported

that a total of 21 entities were given in-principle nod last year,

including 11 for payments banks. Later, three entities-Techs Mahindra,

Cholamandalam Investment and Finance Company and a consortium of Dilip

Shanghvi, IDFC Bank and Telenor Financial Services backed out of the

payments bank licensing.

Here’s all you need to know about the Paytm Payments Bank:

What is the transformation all about?

The Paytm wallet will be made Paytm Payments Bank Ltd (PPBL) after May 23. Your wallet will keep working as it is.

What is changing in Paytm wallet?

The wallet business will get transferred to the new company PPBL but

will keep functioning as it is. As of now, only Airtel and India Post

have started Payments Bank operations. Meanwhile, Aditya Birla Idea

Payments Bank is expected to launch services in the first half of this

year.

What is the aim of transferring Paytm wallet to Paytm Payments Bank Ltd (PPBL)?

The main aim of Paytm Payments Bank will be to cater to the requirements

of the un-served and under-served communities of India, and bring them

to the mainstream economy. We are looking forward to making Paytm

Payments Bank available to all our users very soosoon.

I have to pay anything?

The transfer of wallet into the new entity PPBL will happen

automatically. An individual need not do anything or worry about their

money in the wallet.

What will happen to the money in Paytm wallets?

This means Paytm will transfer its wallet business to the newly

incorporated entity named as the wallet business will become part of the

new company.

Do I have to open a new account after this change?

No, you can continue with your wallet. It will keep working as it is. If

you wish to open a new account with the new payments bank of the

company, you are free to do so.

How do I open a new account in Paytm Payments Bank Ltd?

Paytm will give you an option to open a separate account. An individual

can earn interest on the money if you choose to open a payments bank

account.

How is Paytm Payments Bank different from other banks?

The Paytm Payments Bank Ltd (PPBL) works in a different manner than

usual banks as there is a limit on the money you can keep in your

account. A customer cannot keep more than Rs 1 lakh in the Paytm

payments bank. Payments banks can accept deposits from individuals and

small businesses up to Rs. 1 lakh per account. The PPBL cannot lend or

give advance to customers. It can only issue cheque books and debit

cards but not credit cards.

I don’t want to opt for Paytm Payments Bank Ltd (PPBL), what do I do?

In case consumers do not wish for PPBL, they have to inform Paytm, which

will, in turn, transfer the wallet balance to the consumer’s bank

account once such details are shared. Such communication will have to be

made before May 23.

My Paytm wallet is inactive since last 6 months? Where will my money go?

In case the wallet has been inactive with no activity in the last six

months, the transfer to PPBL will only happen once the consumer gives

specific consent.

Post demonetisation, Paytm emerged as one of the main gainers as a huge

number of people move towards digital currency. Wallet companies like

Paytm and Mobikwik have registered an increase in user base as well as

the number of transactions. The newly launched facility aims to provide

quick and basic banking services to the people. In case consumers do not

wish for that, they have to inform Paytm, which will, in turn, transfer

the wallet balance to the consumer’s bank account once such details are

shared. Such communication will have to be made before May 23.

No comments:

Post a Comment