· Organization’s Name: Staff Selection Commission (SSC)

· Examination’s Name: Combined Graduate Level Examination(CGLE)

· The Application form will be available from: 16th MayF 2017

· Mode of Apply: Online Mode and Offline Mode

· Mode of Exam: Computer Based Test (CBT)

SSC CGL 2017 Notification

- SSC CGL 2017 Application Process has started from 16th May 2017. Official notice has released now, candidates may apply for the same.

- Age of the candidates will now be calculated as on 1st August instead of 1stJanuary of the examination year.

SSC CGL 2017 Notification- Download PDF- Click here

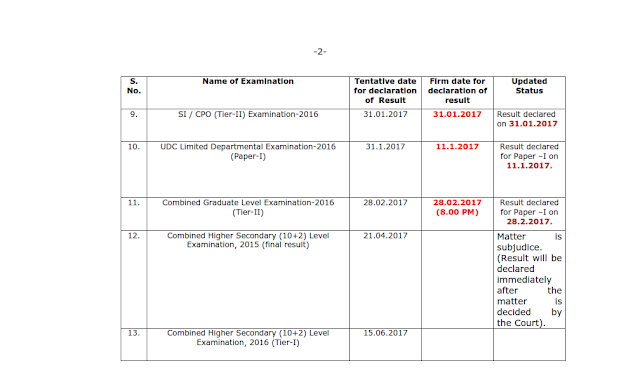

SSC CGL 2017 Exam Dates (Revised)

SSC CGL Tier 1 Examination

|

1st August to 20th August 2017 (CBE)

|

SSC CGL Tier 2 Examination

|

10th November to 11th November 2017

|

SSC CGL Tier 3 Examination

|

21st January 2018

|

Important Dates- Revised

Application form will be available from

|

16th May 2017

|

Last date to apply

|

16th June 2017

|

Admit card will be available for SSC CGL Tier-1

|

July 2017

|

SSC CGL Tier-1 Exam

|

1st Aug to 20th Aug 2017

|

Result declaration for Tier-1

|

September 2017

|

Admit card will be available for SSC CGL Tier-2

|

September 2017

|

SSC CGL Tier-2 Exam

|

10th to 11th Nov 2017

|

Result declaration for CGL Tier-2

|

December 2017

|

SSC CGL Tier-3 Exam

|

21st January 2018

|

Interview/Skill Test/Computer Skill Test

|

February 2018

|

SSC CGL 2017 Application form

The application forms can be obtained from the official website http://ssconline2.gov.in or http://sscregistration.nic.in.

The application forms have to be submitted only through online mode.

The applicants are required to fill all the details as asked in the

application form. They are advised to keep the print out of duly filled

application form for future reference.

SSC CGL 2017 Online Application Procedure-

Eligibility Criteria

· Education: Candidate must have done Graduation in any stream from a recognized university.

· Age Limit – Candidate’s age must be between 18 to 27 years old to be eligible for this examination.

Age Relaxation

S.No

|

Category

|

Age Relaxation

|

1

|

OBC

|

3 yrs

|

2

|

ST/SC

|

5 yrs

|

3

|

Gen +PH

|

10 yrs

|

4

|

OBC+ PH

|

13 yrs

|

5

|

SC/ST+PH

|

15 yrs

|

6

|

Ex-Servicemen (Gen)

|

3 yrs

|

7

|

Ex-Servicemen (OBC)

|

6 yrs

|

8

|

Ex-Servicemen (SC/ST)

|

8 yrs

|

SSC CGL 2017 Eligibility Criteria

Exam Scheme of SSC CGLE (Tier I)

The Commission

has decided to reduce the number of questions from 200 to 100 in CGLE

Tier-I which would continue to carry 200 marks. The duration of Tier-I examination would be for a period of 75 minutes.

Mode of Exam

|

Scheme of Exam

|

Marks

|

Time

|

CBT

(Computer Based)

|

A. General Intelligence & Reasoning: 25 Questions

B. General Awareness: 25 Questions

C. Quantitative Aptitude: 25 Questions

D. English Comprehension: 25 Questions

|

50

50

50

50

|

60 Minutes

for VH and candidates suffering from Cerebral Palsy: 80 Minutes

|

|

|

Total=200

|

|

SSC CGL 2017 Syllabus and Updated Exam Pattern

SSC CGL Tier I Exam Pattern

· The examination will be MCQ type and will be conducted through online mode.

· The question paper will be divided into 4 sections- General intelligence & reasoning, General Awareness/GK, Quantitative aptitude & English comprehension.

· There will be total 100 questions for 200 marks & the duration of the examination will be 75 minutes.

· There will be a penalty of 0.50 marks for each incorrect answer.

SSC CGL Tier II Exam Pattern

· Examination will be MCQ type and will be conducted through online mode.

· Question

paper will be divided into 4 sections- Quantitative ability (Paper I),

English language & Comprehension (Paper II), Statistics (Paper III)

& General studies (Paper IV Finance & Economics).

· The

paper I & II are compulsory for all the posts & paper II is

only for the post of Statistical Investigator Gr. II & Compiler

& Paper IV will only be for the post of Assistant Audit Officer.

· There will be total 200 marks & the duration of the examination will be 2 hours.

· There will be a penalty of 0.25 marks for each incorrect answer in paper II.

SSC CGL Tier III Exam Pattern

· The examination will be of descriptive type & will be conducted only through offline mode.

· The applicants have to write essay/précis/letter/application etc.

· The

examination will be of total 100 marks & the duration will be of 60

minutes. The duration of the examination will be 80 minutes for VH

& Cerebral Palsy applicants.

SSC CGL 2017 Selection Procedure

SSC

CGL Selection procedure contains the four stages. All the candidates

need to success in all the stages and will be selected on the basis

their performance in all the Tiers. CGL Examination will be conducted in

four tiers as given

· Tier -I: Written Examination (Multiple Choice- Computer Based Test)

· Tier -II: Written Examination (Multiple Choice- Computer Based Test)

· Tier -III: Descriptive Test (Pen and Paper Mode)

· Tier -IV: Data Entry Skill Test/Computer Proficiency Test(wherever applicable)/ Document Verification