COM. S. K. VYAS JI REMEMBERANCE DAY. M. KRISHNAN, SECRETARY GENERAL,

CONFEDERATION ADDRESSING MEETING AT TRIVANDRUM ON 13.02.2017.

Fundamental (Amendment) Rules, 2017 – DOPT

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS

(Department of Personnel and Training)

NOTIFICATION

New Delhi, the 23rd January, 2017

G.S.R. 69(E).—In exercise of the powers conferred by the proviso to the

article 309 of the Constitution, the President hereby makes the

following rules further to amend the Fundamental Rules, 1922, namely : –

1. (1) These rules may be called the Fundamental (Amendment) Rules, 2017

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Fundamental Rules, 1922, in rule 56, in clause (d), after the

sixth proviso, the following proviso shall be inserted, namely:–

“Provided also that notwithstanding anything contained in the fifth

proviso, the Central Government may, if considers necessary, in public

interest, so to do, give an extension in service for a further period

not exceeding one year beyond the said period of two years to the

Foreign Secretary”.

[F. No. 26012/1/2017-Estt. (A-IV)]

GYANENDRA DEV TRIPATHI, Jt. Secy.

OPERATIONAL PROCEDURE IN R/O SANCTIONING OF PLI INCENTIVE

OPERATIONAL PROCEDURE IN R/O SANCTIONING OF PLI INCENTIVE

- Go to www.indiapost.gov.in

- Go to Postal Life Insurance>Agents

- Enter Agent ID, Password and given captcha (If already user exists, if not create the ID)

- You will logged in to Agent ID

- Go to Business reports

- Enter the year for which commission to be sanctioned and Click “Generate Report”

7. An excel will be downloaded at the left end bottom as show in screenshot. Open it.

8. A excel will be downloaded with the following information.

9.

Remove the columns like premium frequency, Product Name, Payment Method

and make the changes which are yellow marked in this screenshot.

10. Login into Mc camish and go to “collection” screen

11. Click “Renewal” and the following screen will be displayed

12. Go to the Excel sheet downloaded and copy the policy numbers which are procured by the agent

13. Give the copied policy numbers in the collection

14. With the help of the screenshot above enter the premium paid till in the excel

15. With the help of no. of credits enter the effective business and In-effective business

16. Now, Calculate incentive with the help of effective business given above

17. After approval of calculation, the sanction memo is to be sanctioned in the following format

Latest FAQ on Clearing both inward and outward clearing in DOP Finacle

1. What is Inward Clearing?

Inward clearing is a cheque drawn by a drawer (DoP customer) from a

drawee bank (DoP) in favor of a customer belonging to other bank which

is the presenting bank.

2. What is Outward Clearing?

Outward clearing is when cheques drawn by other bank customers are

presented for clearing by presenting bank (DoP) in favor of their

customer (DoP customer) to drawee bank for clear funds.

3. How do I open a zone in finacle and make entries in the zone?

For Inward Clearing zone can be opened by using menu option HMICZ and

respective entries can be made in the zone by using HICTM menu.

For Outward Clearing zone can be opened by using menu option HMCLZOH and

respective entries can be made in the zone by using HOCTM menu.

4. What are the steps to be followed in case of Inward Clearing zone?

In Inward Clearing below step by step process can be followed:

a. Open zone in HMICZ using function ‘O’.

b. Make entries manually using menu HICTM or for bulk entries use menu HRMI to upload a file.

c. Authorizer to login and use menu HMICZ menu to suspend the zone.

d. Then invoke menu HICTM to verify the entries uploaded.

e. Then invoke validation run report in HMICZ.

f. Check HPR validation report for any discrepancies in the accounts under clearing.

g. Then invoke HMICZ revoke the zone so that action can be taken on accounts with discrepancy.

h. User to appropriately take action by rejecting the instruments in HICTM

i. Authorizer to verify the modified instruments in HICTM.

j. Then invoke HMICZ suspend the zone.

k. Invoke HMICZ check for account statistics and check for fields

received but not listed and listed but not received and make sure it is

zero so that unnecessary credit to short claim and excess claim account

can be avoided. Posting can be invoked after checking the account

statistics screen.

l. Once posting is complete proceed with closure of zone in HMICZ.

5. What if my zone is not getting posted?

a. Check for error report in HPR.

b. Check HICTM if all instruments are verified

c. Check validation status in HMICZ to be complete

6. How do I check the status of individual instruments lodged in Inward Clearing from front end?

- Invoke menu HICI and give account number and click on GO.

7. What if my zone is locked?

Invoke menu HUNLKZ to unlock the locked zone.

8. What if duplicate instrument is added in the zone?

Section A – shows the Information when the issue is faced.

If duplicate instrument is added in the zone and user did not check the

validation report and posting has been initiated. In such case system

will create a partly posted transaction with un-posted part tran in

entered status and consolidated amount in SHORT CLAIM account for all

the duplicate cheque entries.

Section B – shows steps to be taken to solve the issue

In such cases user to follow below approach:

Mark the duplicate instrument as rejected with appropriate reject reason

code. Also see that if any charges are applied to the customer, the

same need to be reversed / amount of the charges to be collected can be

made as “zero” in HICTM screen. Please refer the below document for step

by step process.

9. What are the steps to be followed in case of Outward Clearing?

a. Open zone in HMCLZOH using function ‘O’.

b. Make entries manually using menu HOCTM or for bulk entries use menu HCLUPLD to upload a file.

c. Authorizer to login and use menu HMCLZOH menu to suspend the zone.

d. Then invoke menu HOCTM to verify the entries uploaded.

e. In case of any bank not participating in return clearing for Inward

invoke menu HMARKPND to markpend all those instruments or bank as a

whole to hold these instruments.

f. Then invoke HMCLZOH to release the zone to shadow balance.

g. For rejection of outward instruments user to open inward zone OWRTN-MICR.

h. User to appropriately take action by rejecting the instruments in HICTM

i. Authorizer to verify the modified instruments in HICTM.

j. Then invoke HMICZ suspend the zone.

k. Invoke HMICZ check for account statistics and check for fields

received but not listed and listed but not received and make sure it is

zero so that unnecessary credit to short claim and excess claim account

can be avoided. Posting can be invoked after checking the account

statistics screen.

l. Once posting is complete proceed with closure of zone in HMICZ.

m. Similarly in HMCLZOH, initiate regularization of the zone and proceed with closure of the zone in HMCLZOH.

10. What if a customer had deposited a non DoPchequein outward clearing and funds are not available in the account?

- User to invoke HOIQ menu to check the status of the deposited cheque.

- Check HACLI to check for field “Funds in Clearing”.

11. How do I check the status of inward and outward zone?

- Invoke HMCLZOH for outward clearing and inquire on the zone status.

- Invoke HMICZ for inward clearing and inquire on the zone status.

12. What if I have all part transaction released to shadow balance have not been posted?

Invoke HMCLZOH to check the status of the zone. If in released status proceed with regularization.

Invoke HTM and post the transaction.

13. What if regularization of zone is not happening?

Invoke menu HMARKPND and check for any mark pending done for any

instrument or bank. If record exists, invoke menu HREVPND for revoking

the mark pending done. Post this regularization can be done in menu

HMCLZOH.

14. What if a wrong date (stale date or future date which is more than 3 months from existing date) is entered?

User to check validation run report and modify the record in HICTM and correct the date.

15. What if accounts in outward clearing have received the credit and the zone status shows as released to shadow balance?

This is due to mark pend done on some instruments in menu HMARKPND and

regularization done in HMCLZOH where other than mark pend instruments

receive the credit and others remain in released to shadow balance along

with the outward zone MICROW. Invoke HREVPND to revoke the mark pend

and proceed with remaining zone regularization of zone in HMCLZOH.

FIXATION OF SENIORITY OF GOVERNMENT SERVANTS PROMOTED ON THE BASIS OF RESERVATION FOR PROMOTION TO SC AND ST

FIXATION OF SENIORITY OF GOVERNMENT SERVANTS PROMOTED ON THE BASIS OF RESERVATION FOR PROMOTION TO SCHEDULED CASTE AND SCHEDULED TRIBE - Important Supreme Court Order

Click here to view - Supreme Court Order

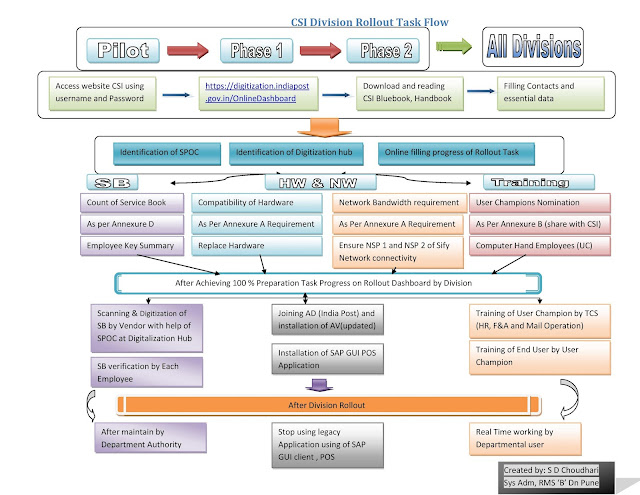

CSI Division Roll-out Task flow

IPPB - Funds allocated by Govt

The government has allocated Rs125 crore as capital infusion for India Post Payments Bank and Rs375 crore as grant in aid .

New

Delhi: The government has allocated Rs500 crore to India Post Payments

Bank for the financial year 2017-18 as it gears up to set up 650

branches across country by September 2017.

The

government has allocated Rs125 crore as “capital infusion into

corporate entity for India Post Payments Bank” and Rs375 crore as “grant

in aid to India Post Payments Bank (IPPB)”, as per Output-Outcome

Framework for Schemes 2017-18 for the department of posts (DoP) released

on Monday.

India

Posts is the second entity to roll out payments bank—though on a pilot

basis—in Raipur and Ranchi, after Airtel that has earmarked Rs3,000

crore as initial investment for pan-India operations with an interest

rate of 7.25% on deposits. Besides, Airtel is offering free money

transfer from Airtel to Airtel numbers within Airtel Bank, money

transfer to any bank account in the country.

The

IPPB will offer an interest rate of 4.5% on deposits up to Rs25,000; 5%

on deposits of Rs25,000-50,000 and 5.5% on Rs50,000-1,00,000. The total

paid up equity of the new bank IPPB is Rs 800 crore, of which the

government has already infused Rs275 crore.

Payments

banks can accept deposits up to Rs1 lakh per account from individuals

and small businesses. The new model of banking allows mobile firms,

super market chains and others to cater to banking requirements of

individuals and small businesses. The allocation to IPPB is part of

Rs1,034.13 crore earmarked for the department of posts. The second big

chunk of the total allocation, Rs279.6 crore, has been allocated for

providing IT hardware and software in identified rural areas for

improved access to services and customer satisfaction, resulting in

increase in customer transactions, traffic and revenue.

The

DoP has been allocated Rs110.83 crore for establishing e-commerce,

parcel booking, international business centres, Rs73.5 crore for estates

management, Rs32 crore for mail operations and Rs17.7 crore for

equipments and IT infrastructure in rural post offices. The government

has allocated Rs3.8 crore for setting up 246 offices and 200 outlets for

providing better access to communication and financial services.

//copy//

AIPEU GDS - Nahan Branch (Himachal Pradesh) Conference

No comments:

Post a Comment